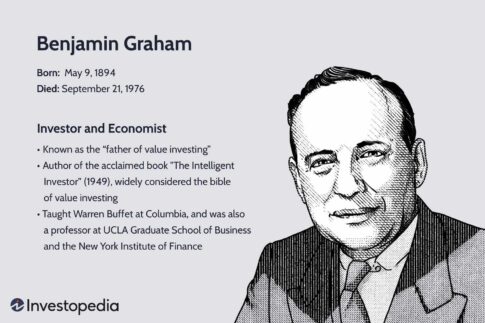

Benjamin Graham (1894–1976) was a legendary figure in the world of finance and investment. He was born in London and moved to the United States with his family when he was a young child. Graham is often referred to as the “father of value investing” and is best known for his pioneering work in security analysis and his influential book, “The Intelligent Investor.”

Benjamin Graham (1894–1976) was a legendary figure in the world of finance and investment. He was born in London and moved to the United States with his family when he was a young child. Graham is often referred to as the “father of value investing” and is best known for his pioneering work in security analysis and his influential book, “The Intelligent Investor.”

Graham’s career in finance began in the early 1900s. After earning his degree from Columbia University, he started working on Wall Street. In 1926, he founded the Graham-Newman Corporation, an investment partnership, with his colleague Jerome Newman. This partnership was one of the earliest examples of hedge funds.

Graham’s most significant contributions to the field of finance came through his writing and teaching. In 1934, he published “Security Analysis” with David Dodd, a book that laid the groundwork for modern security analysis and value investing. This book emphasized the importance of fundamental analysis and the concept of intrinsic value, which became foundational principles for investors worldwide.

However, Graham’s most famous work is “The Intelligent Investor,” first published in 1949. In this book, Graham introduced his philosophy of value investing, advocating for a disciplined, long-term approach to stock market investing. He emphasized the importance of thorough research, margin of safety, and emotional discipline in investing.

Graham’s approach to investing was based on the idea of buying stocks when they were trading below their intrinsic value, thus providing a margin of safety against potential losses. He believed in focusing on the fundamentals of companies rather than market trends or speculation.

Throughout his career, Graham mentored numerous successful investors, including Warren Buffett, who considered Graham his mentor and the most influential figure in his investment philosophy.

In addition to his writing and investment career, Graham also taught at Columbia Business School, where he influenced generations of students with his ideas on investing. He retired from teaching in 1956 but remained active in the financial world until his death in 1976.

Benjamin Graham’s legacy continues to influence investors around the world. His emphasis on value investing, disciplined analysis, and long-term thinking remains as relevant today as it was during his lifetime.

Referance : Chargpt