INTRODUCATION

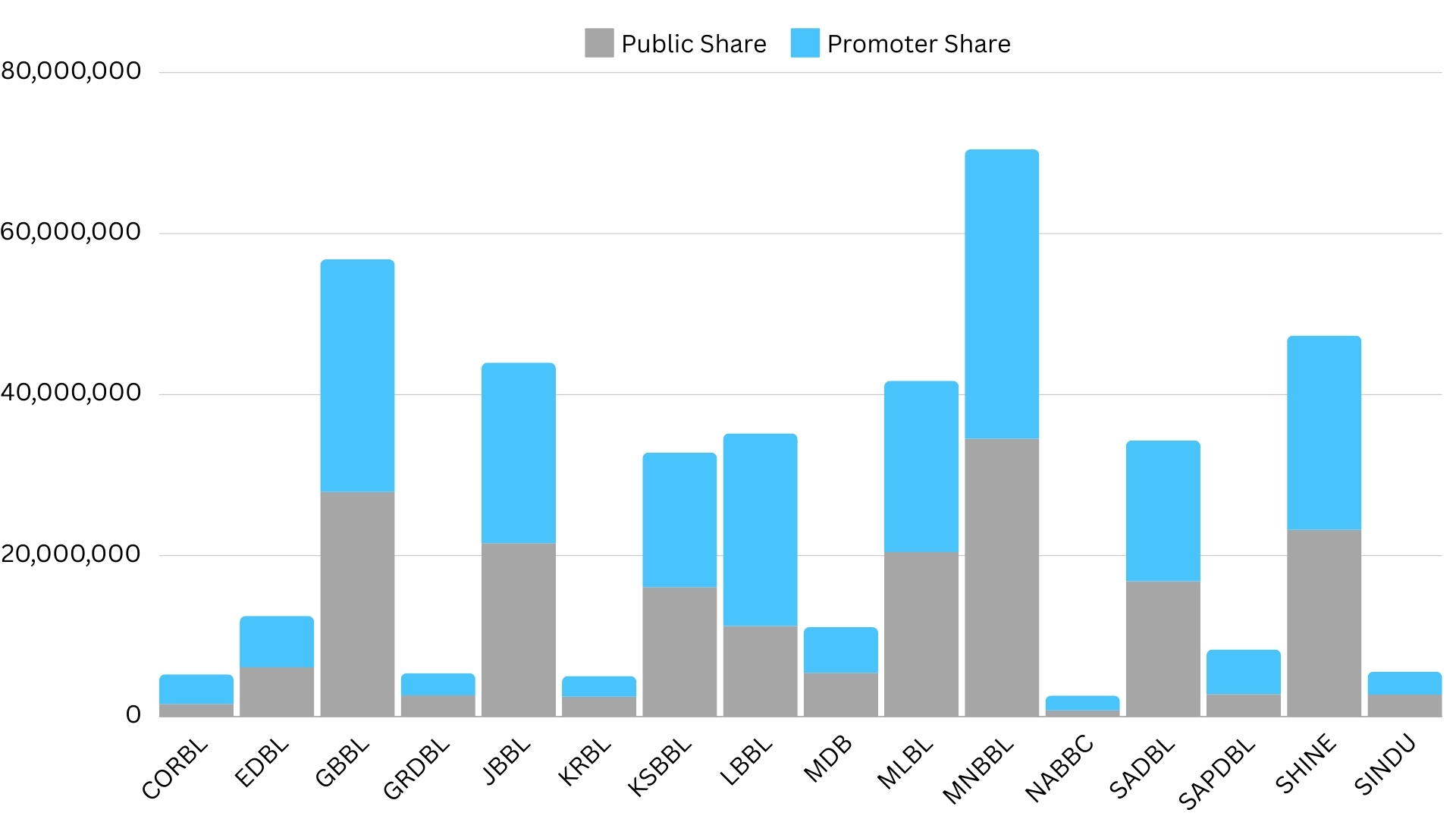

Several development banks are listed on the Nepal Stock Exchange (NEPSE), with varying shares held by the public and promoters. For CORBL, there are 1,575,000 public shares and 3,675,000 promoter shares. EDBL holds 6,123,503 public shares and 6,373,442 promoter shares. GBBL has 27,901,282 public shares and 28,903,893 promoter shares, while GRDBL’s public shares are 2,639,738, with 2,747,482 promoter shares. JBBL’s public shares amount to 21,539,351, and promoter shares total 22,418,509. Similarly, KRBL holds 2,463,867 public shares and 2,564,433 promoter shares. KSBBL has 16,077,708 public shares and 16,733,940 promoter shares.

For LBBL, public shares stand at 11,254,511, while promoter shares reach 23,926,831. MDB’s public shares are 5,445,990, and its promoter shares total 5,668,277. MLBL holds 20,439,461 public shares and 21,273,725 promoter shares. MNBBL has the highest number of shares, with 34,529,997 public shares and 35,939,385 promoter shares. NABBC holds 787,403 public shares and 1,837,273 promoter shares. SADBL has 16,811,760 public shares, with promoter shares totaling 17,497,954. SAPDBL has 2,800,874 public shares and 5,542,511 promoter shares. SHINE holds 23,195,086 public shares and 24,141,825 promoter shares, while SINDU has 2,731,535 public shares and 2,843,026 promoter shares.

THIS DATA IS OF UP TO OCT 4 2024

PUBLIC SHARE

PROMOTER SHARE

BAR GRAPH

DEVEBANK INDEX CHART

THIS CHART IS FROM NEPSEALPHA VISIT NEPSE ALPHA FOR MORE DETAILS

California: The Golden State

California: The Golden State

In the annals of modern commerce, few entities stand as prominently as Amazon. From its humble beginnings as an online bookstore to its current status as a global tech giant, the journey of Amazon is nothing short of extraordinary. As we delve into its present and past, we uncover a narrative of innovation, disruption, and relentless ambition.

In the annals of modern commerce, few entities stand as prominently as Amazon. From its humble beginnings as an online bookstore to its current status as a global tech giant, the journey of Amazon is nothing short of extraordinary. As we delve into its present and past, we uncover a narrative of innovation, disruption, and relentless ambition. Pioneering E-Commerce

Pioneering E-Commerce The Retail Revolution

The Retail Revolution Future Prospects

Future Prospects