In the first quarter of fiscal year 2081/82, Arun Valley Hydropower Development Company Limited (AHPC) demonstrated robust financial growth across multiple metrics. The company’s paid-up capital doubled, reaching Rs. 3.73 Arba, up from Rs. 1.87 Arba in Q1 2080/81, while its reserves and surplus surged by 231.59%, rising from Rs. 7.70 crores to Rs. 25.53 crores, indicating enhanced financial resilience.

Property, plant, and equipment assets increased by 3.83% to Rs. 2.61 Arba, reflecting continued infrastructure investments. The company’s investment portfolio also grew substantially by 64.94%, totaling Rs. 1.23 Arba compared to Rs. 74.83 crores in the previous year’s quarter. Revenue from power sales was a major highlight, soaring by 485.57% to Rs. 7.74 crores from Rs. 1.32 crores, driving a significant increase in net profit, which jumped 720.51% to Rs. 11.32 crores, up from Rs. 1.38 crores last year.

Administrative expenses rose by 40.37% to Rs. 11.10 lakhs, while finance expenses sharply declined by 70.72%, dropping from Rs. 4.21 crores to Rs. 1.23 crores, likely contributing to the boosted net profit. The company’s annualized earnings per share (EPS) climbed to Rs. 12.12, a 310.26% increase from Rs. 2.96 last year. Net worth per share also saw a modest improvement of 2.60%, reaching Rs. 106.83, compared to Rs. 104.12 in the previous period.

By the quarter’s close, AHPC’s price-to-earnings (PE) ratio was recorded at 23.84, with a market price of Rs. 289 per share.

SEE Q1 REPORT

Financial Summary – Arun Valley Hydropower Development Company

| Particulars (In Rs ‘000) | Q1 2081/82 | Q1 2080/81 | Difference (%) |

|---|---|---|---|

| Total Assets and Revenue | – | – | – |

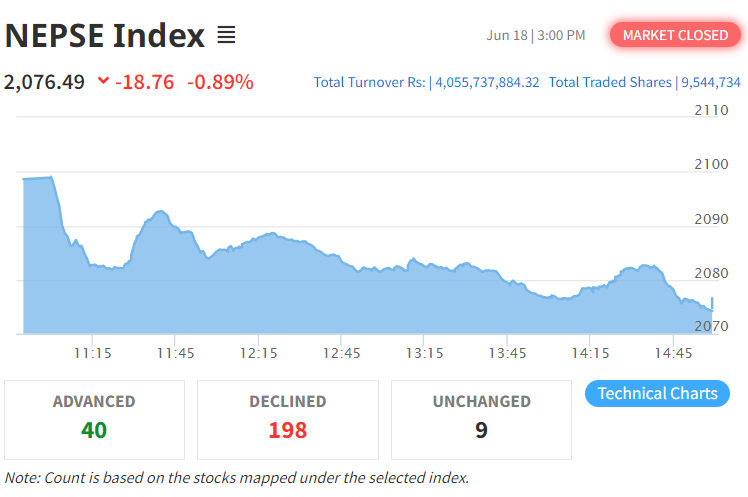

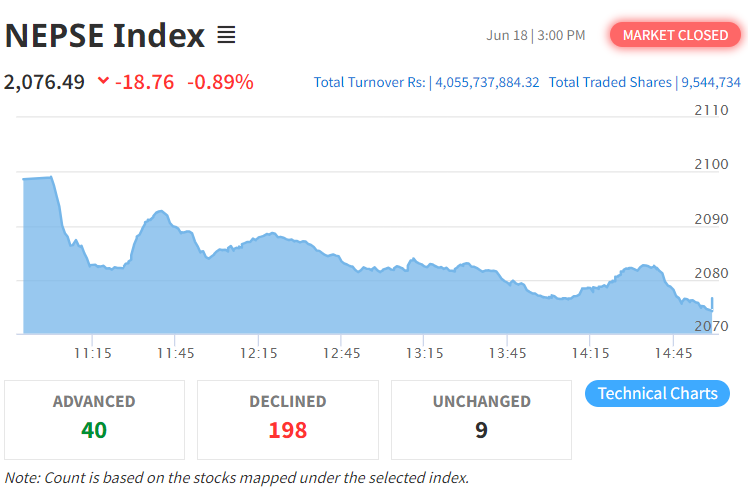

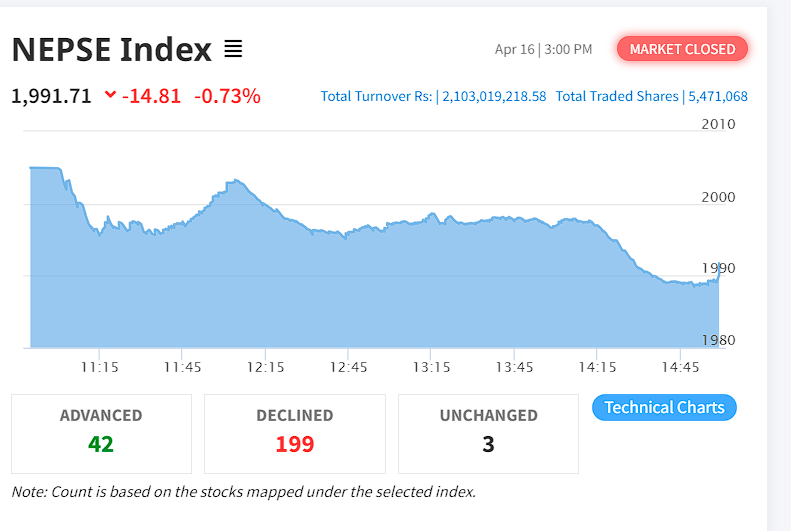

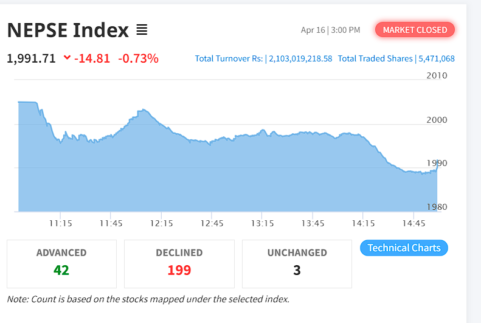

नेप्से घटेपनि यस दिन समाज लघुवित्तको शेयर भने सकारात्मक सर्किट लेभलमा कारोबार भएको छ। यस दिन सो लघुवित्तको शेयरमूल्य २१९ रुपैयाँ बढेर २ हजार ४०९ रुपैयाँमा अन्तिम कारोबार भएको छ। त्यस्तै, यस दिन माण्डु हाइड्रोपावरको शेयरमूल्य करिब ८ प्रतिशत बढेको छ भने विन नेपाल लघुवित्तको शेयरमूल्य ६ प्रतिशतभन्दा बढी बढेको छ। यस दिन दुई स्टकको शेयर नकारात्मक सर्किट लेभलमा कारोबार भएको छ। यस दिन मनकामना स्मार्ट लघुवित्त र कुथेली बुखरी स्मल हाइड्रोपावरको शेयर नकारात्मक सर्किट लेभलमा कारोबार भएको हो।

नेप्से घटेपनि यस दिन समाज लघुवित्तको शेयर भने सकारात्मक सर्किट लेभलमा कारोबार भएको छ। यस दिन सो लघुवित्तको शेयरमूल्य २१९ रुपैयाँ बढेर २ हजार ४०९ रुपैयाँमा अन्तिम कारोबार भएको छ। त्यस्तै, यस दिन माण्डु हाइड्रोपावरको शेयरमूल्य करिब ८ प्रतिशत बढेको छ भने विन नेपाल लघुवित्तको शेयरमूल्य ६ प्रतिशतभन्दा बढी बढेको छ। यस दिन दुई स्टकको शेयर नकारात्मक सर्किट लेभलमा कारोबार भएको छ। यस दिन मनकामना स्मार्ट लघुवित्त र कुथेली बुखरी स्मल हाइड्रोपावरको शेयर नकारात्मक सर्किट लेभलमा कारोबार भएको हो।

नेपाल स्टक एक्सचेञ्जको

नेपाल स्टक एक्सचेञ्जको