A contrarian approach to investing involves going against the prevailing market sentiment. Instead of following the crowd, contrarian investors seek opportunities in stocks that are undervalued or overlooked by the majority of investors. Here’s how to focus on fundamentally strong stocks using a contrarian approach:

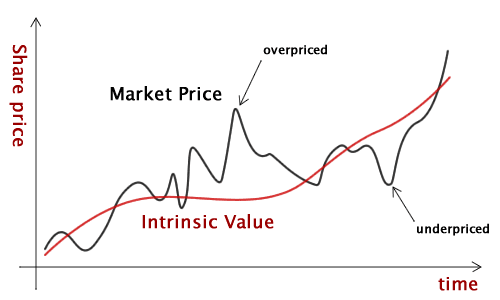

- Identify Market Mispricings: Look for stocks that are trading below their intrinsic value due to temporary setbacks, negative sentiment, or short-term challenges. This could include companies experiencing a temporary decline in earnings, undergoing a restructuring, or facing industry-specific headwinds.

- Focus on Unpopular Sectors or Industries: Contrarian investors often find opportunities in sectors or industries that are out of favor with the market. While others may be avoiding these areas, you can find fundamentally strong companies with solid long-term prospects trading at discounted prices.

- Search for Neglected Stocks: Look for stocks that have been overlooked or neglected by investors, perhaps because they are small-cap or mid-cap companies, or they operate in niche markets. These stocks may be undervalued despite having strong fundamentals.

- Evaluate Market Sentiment: Pay attention to market sentiment indicators such as investor sentiment surveys, analyst ratings, and media coverage. When sentiment is overly pessimistic, it may create buying opportunities in fundamentally strong stocks.

- Contrarian Screening: Use screening tools to identify stocks that meet contrarian criteria, such as low Price-to-Earnings ratios compared to historical averages, low Price-to-Book ratios, or high dividend yields. This can help you uncover potential opportunities that others may have overlooked.

- Risk Management: Assess the risks associated with contrarian investing, including the possibility that the market may be correct in its negative sentiment about a particular stock or sector. Diversification and proper risk management are essential to mitigate potential losses.

- Long-Term Perspective: Contrarian investing often requires patience, as it may take time for the market to recognize the value in a stock that is currently out of favor. Maintain a long-term perspective and focus on the underlying fundamentals of the companies you invest in.

- Research and Due Diligence: Conduct thorough research and due diligence on the companies you’re considering investing in. Analyze financial statements, industry trends, competitive positioning, and management quality to ensure that the stocks you choose are indeed fundamentally strong.

- Be Prepared to Swim Against the Tide: Contrarian investing can be psychologically challenging, as it often involves going against the prevailing market sentiment. Be prepared to withstand criticism and skepticism from others while sticking to your investment thesis.

By adopting a contrarian approach and focusing on fundamentally strong stocks that are undervalued or overlooked by the market, you may be able to uncover attractive investment opportunities and achieve superior long-term returns.

Long-Term Success:

Long-Term Success:

London,

London,

Intel

Intel