Finding undervalued assets is a core principle of value investing, popularized by Benjamin Graham and David Dodd in their book “Security Analysis.” Here are some strategies commonly used to identify undervalued assets:

1. Fundamental Analysis: This involves analyzing a company’s financial statements, such as its balance sheet, income statement, and cash flow statement, to determine its intrinsic value. Look for companies with strong fundamentals but whose stock prices do not reflect their true worth.

2. Price-to-Earnings (P/E) Ratio: Compare a company’s current stock price to its earnings per share (EPS). A low P/E ratio relative to its industry or historical average may indicate that the stock is undervalued.

3. Price-to-Book (P/B) Ratio: Divide the stock’s price by its book value per share (total assets minus liabilities). A P/B ratio below 1 suggests that the stock is trading for less than its net asset value, potentially indicating undervaluation.

4. Dividend Yield: Look for companies with high dividend yields relative to their industry or historical averages. A high dividend yield can indicate that the stock is undervalued, as the market may not fully appreciate the company’s income-generating potential.

5. Discounted Cash Flow (DCF) Analysis: Estimate the present value of a company’s future cash flows by discounting them back to their present value. If the calculated intrinsic value is higher than the current stock price, the stock may be undervalued.

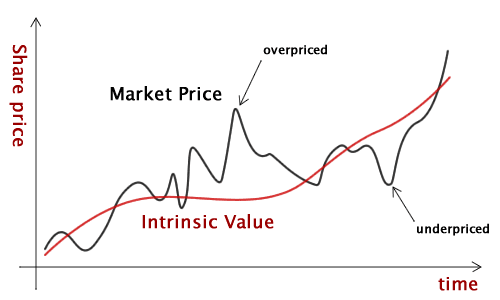

6. Margin of Safety: This concept, introduced by Benjamin Graham, suggests that investors should only purchase a stock if its market price is significantly below its intrinsic value, providing a buffer against potential losses.

7. Contrarian Investing: Look for stocks that are out of favor with the market or have experienced a significant price decline. Contrarian investors believe that market sentiment can sometimes be irrational, leading to mispriced assets.

8. Catalysts for Change: Identify potential catalysts that could lead to a revaluation of the asset, such as new product launches, management changes, or industry trends.

9. Asset-Based Valuation: Evaluate the company’s assets (both tangible and intangible) and compare them to the market capitalization. If the market values the company lower than its assets, it could indicate undervaluation.

10. Qualitative Analysis: Consider qualitative factors such as industry dynamics, competitive positioning, management quality, and growth prospects. A company with strong qualitative factors may be undervalued if these qualities are not fully reflected in its stock price.

Remember that investing in undervalued assets carries risks, and thorough research and analysis are essential to mitigate these risks. Additionally, market conditions and investor sentiment can change, so it’s important to regularly reassess your investment thesis.