Himalayan Laghubitta Bittiya Sanstha Limited (HLBSL) has announced it will not be distributing dividends for the fiscal year 2080/81. This decision was made during the company’s 234th Board Meeting, held on Kartik 12, 2081. However, the finalization of this decision depends on the approval of HLBSL’s financial statements by Nepal Rastra Bank and the company’s Annual General Meeting.

At the time of this announcement, HLBSL’s share price closed at Rs. 979.00.

| S.N. | Bonus Dividend (%) | Cash Dividend (%) | Total Dividend (%) | Announcement Date | Book Closure Date | Distribution Date | Bonus Listing Date | Fiscal Year |

|---|---|---|---|---|---|---|---|---|

| 1 | 11.00 | 0.58 | 11.58 | 2023-01-29 | 2023-02-26 [Closed] | 2023-07-20 | 2023-07-20 | 2078/2079 |

| 2 | 19.00 | 1.00 | 20.00 | 2021-09-30 | 2021-10-31 [Closed] | 2022-02-15 | 2022-02-15 | 2077/2078 |

| 3 | 3.5 | 0.1842 | 3.6842 | 2021-01-12 | 2021-03-04 [Closed] | 2021-07-08 | 2021-07-08 | 2076/2077 |

.png)

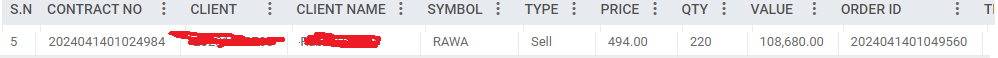

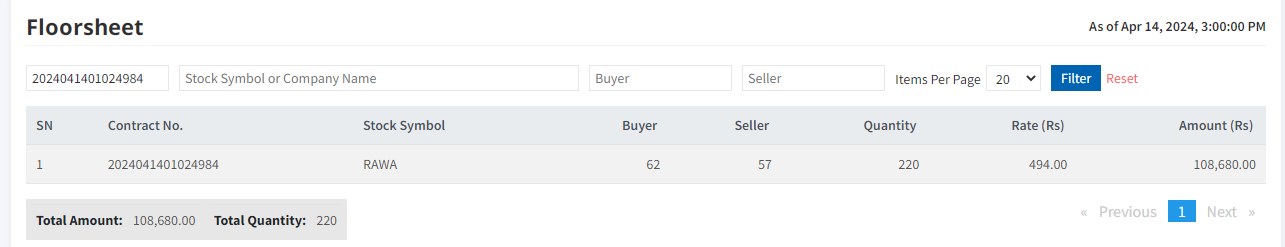

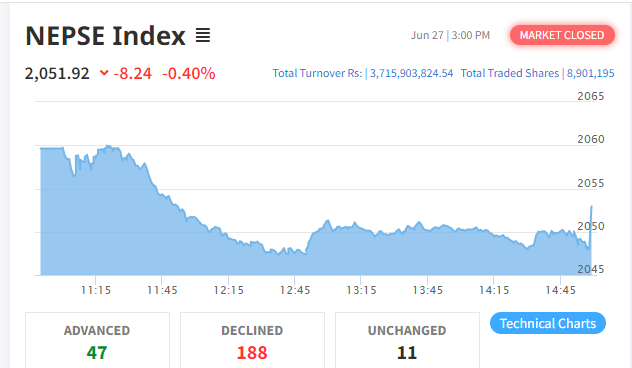

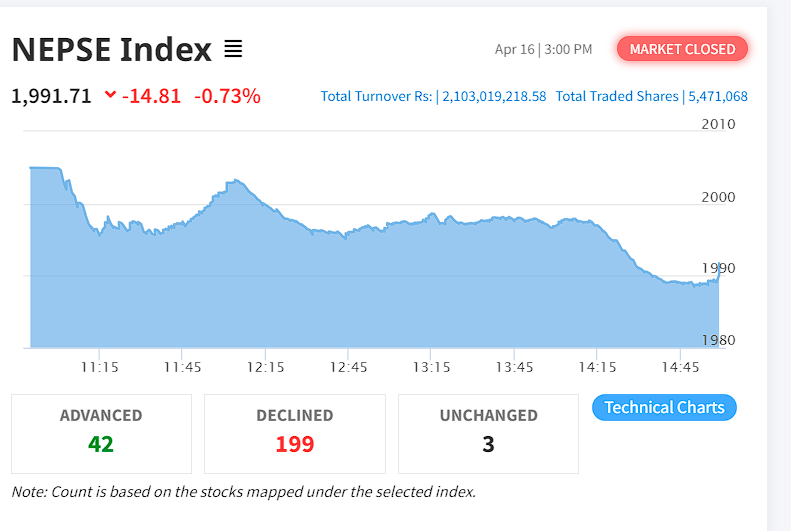

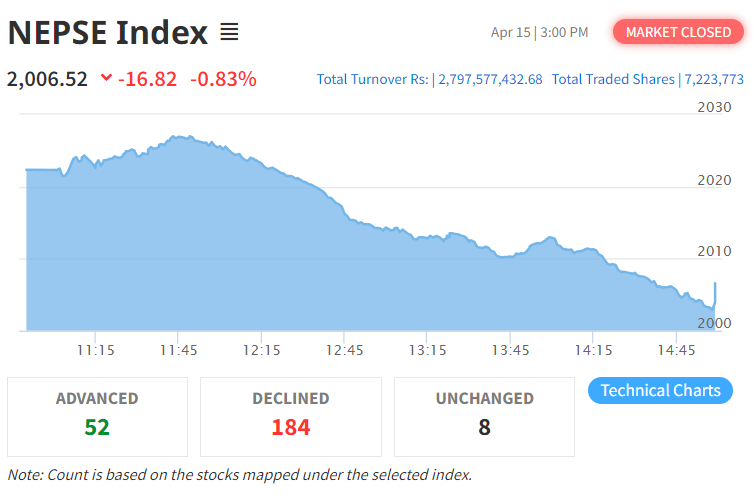

The Nepal Stock Exchange

The Nepal Stock Exchange

प्रभु केबुलकार एन्ड टुरिज्म लिमिटेडले

प्रभु केबुलकार एन्ड टुरिज्म लिमिटेडले

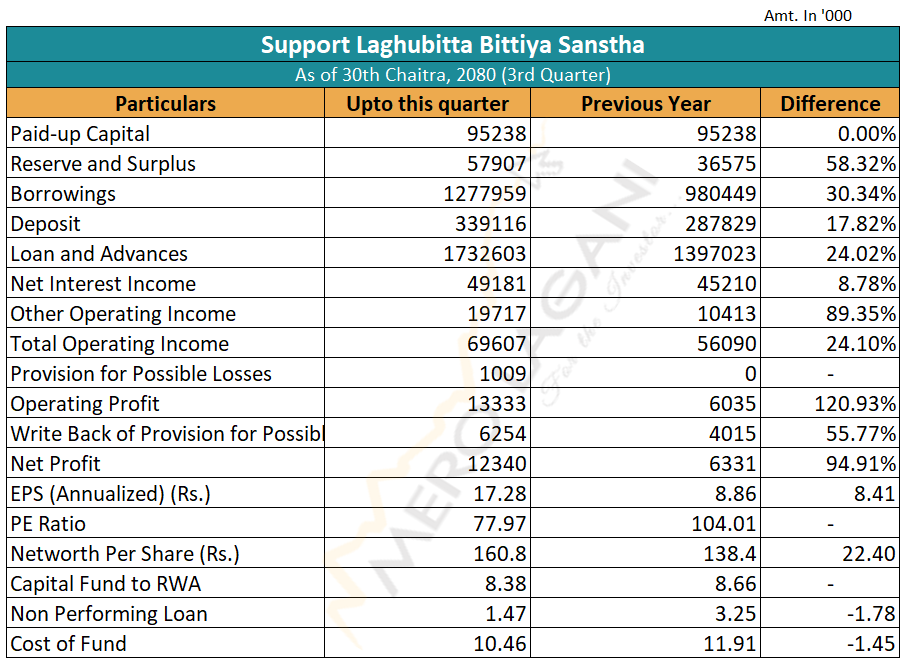

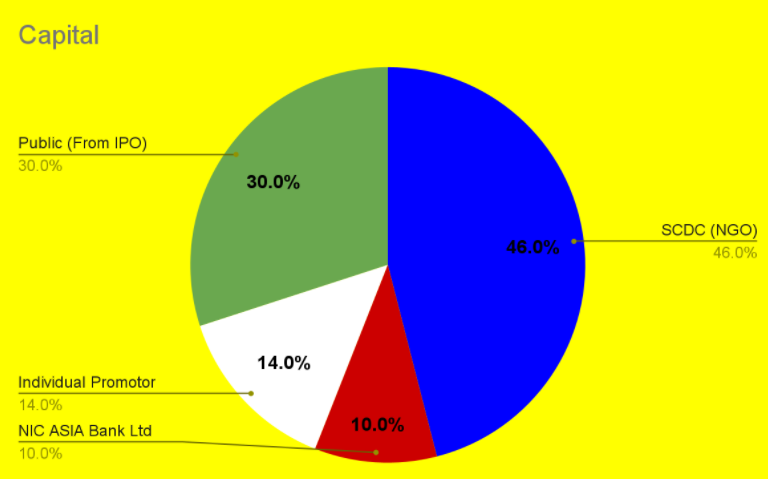

Shrijanshil Laghubitta Bittiya Sanstha

Shrijanshil Laghubitta Bittiya Sanstha

नेपाल स्टक एक्सचेञ्जको

नेपाल स्टक एक्सचेञ्जको