Title: Unveiling the Power of Graphics Processing Units (GPUs): A Comprehensive Exploration

Introduction to Graphics Processing Units (GPUs):

In the realm of modern computing, Graphics Processing Units (GPUs) have emerged as indispensable components driving innovation across various industries. Initially developed to handle graphical tasks such as rendering images and videos for gaming and multimedia applications, GPUs have evolved into powerful parallel processing units capable of tackling complex computational workloads. In this comprehensive exploration, we delve into the architecture, functionality, applications, and future trends of GPUs, unraveling the profound impact they have had on technology and society.

Understanding GPU Architecture:

At the heart of every GPU lies a sophisticated architecture optimized for parallel processing. Unlike Central Processing Units (CPUs), which excel at executing sequential instructions, GPUs are designed to perform numerous calculations simultaneously, leveraging thousands of processing cores known as CUDA cores or stream processors. This parallelism enables GPUs to excel in tasks that involve vast amounts of data, such as image and video processing, scientific simulations, and machine learning algorithms.

The architecture of a GPU typically comprises several key components, including:

- CUDA Cores: These are the fundamental building blocks of a GPU, responsible for executing instructions in parallel. Modern GPUs feature thousands of CUDA cores, allowing for massive parallelization and high computational throughput.

- Memory Hierarchy: GPUs consist of multiple levels of memory, including on-chip caches, dedicated video memory (VRAM), and system memory (RAM). This hierarchical structure optimizes data access and transfer, minimizing latency and maximizing bandwidth.

- Compute Units: GPU cores are organized into compute units, each equipped with its own set of resources, including registers, shared memory, and specialized function units. This modular design facilitates efficient task scheduling and resource allocation.

- Graphics Pipeline: In addition to parallel computation, GPUs feature dedicated hardware for graphics rendering, comprising vertex shaders, geometry shaders, rasterization units, and pixel shaders. This pipeline enables real-time rendering of immersive visual experiences, essential for gaming, virtual reality (VR), and computer-aided design (CAD) applications.

Applications of GPU Technology:

The versatility and computational prowess of GPUs have catalyzed innovation across a wide range of domains, transcending their origins in graphics rendering. Some notable applications of GPU technology include:

- Gaming: GPUs remain integral to the gaming industry, delivering realistic graphics, immersive environments, and fluid gameplay experiences. Advanced rendering techniques such as ray tracing and global illumination leverage the parallel processing capabilities of GPUs to simulate complex lighting effects and realistic shadows, enhancing visual fidelity and immersion.

- Data Science and Machine Learning: GPUs have become indispensable tools for data scientists and machine learning practitioners, accelerating the training and inference of deep neural networks. Frameworks like TensorFlow, PyTorch, and CUDA enable developers to harness the computational power of GPUs to process massive datasets, train complex models, and deploy AI solutions for tasks ranging from image recognition to natural language processing.

- Scientific Computing: GPUs are widely used in scientific simulations and computational modeling, enabling researchers to simulate complex phenomena, analyze large datasets, and solve computationally intensive problems in fields such as physics, chemistry, and engineering. GPU-accelerated libraries and frameworks like CUDA, OpenCL, and NVIDIA CUDA Toolkit provide a scalable and efficient platform for parallel computing.

- High-Performance Computing (HPC): In the realm of high-performance computing, GPUs have emerged as key enablers of breakthrough scientific discoveries and engineering advancements. Supercomputers equipped with GPU accelerators deliver unprecedented levels of computational performance, enabling simulations of climate patterns, molecular dynamics, astrophysical phenomena, and more.

Emerging Trends and Future Directions:

Looking ahead, the future of GPU technology holds immense promise, driven by ongoing advancements in hardware, software, and applications. Some notable trends and developments include:

- Ray Tracing and Real-Time Rendering: The adoption of ray tracing technology in gaming and graphics rendering is poised to revolutionize visual realism, ushering in a new era of lifelike graphics and immersive experiences. With the advent of dedicated hardware support for ray tracing in GPUs, real-time rendering of complex lighting effects and reflections is becoming increasingly feasible.

- AI and Deep Learning Acceleration: As the demand for AI-driven solutions continues to grow, GPUs will play a crucial role in accelerating deep learning algorithms and neural network inference. Hardware innovations such as tensor cores and sparsity support enable GPUs to handle increasingly complex AI workloads, paving the way for advancements in natural language processing, computer vision, and autonomous systems.

- Edge Computing and IoT: The proliferation of edge devices and Internet of Things (IoT) sensors is driving the need for localized processing and inference capabilities. GPUs with low-power architectures and efficient neural network accelerators are well-suited for edge computing applications, enabling real-time analytics, image recognition, and predictive maintenance in resource-constrained environments.

- Quantum Computing Integration: The convergence of GPU technology with emerging paradigms such as quantum computing holds the potential to unlock new frontiers in computational science and engineering. Hybrid architectures combining classical GPUs with quantum processors offer the promise of scalable and versatile computing platforms capable of tackling previously intractable problems in cryptography, optimization, and material science.

Conclusion:

In conclusion, Graphics Processing Units (GPUs) represent a cornerstone of modern computing, driving innovation and enabling transformative advancements across diverse domains. From their origins in graphics rendering to their pivotal role in artificial intelligence, scientific computing, and beyond, GPUs have reshaped the technological landscape and expanded the horizons of what is possible. As we embark on the next chapter of computational evolution, the future of GPU technology holds boundless potential, promising to unlock new realms of discovery, creativity, and innovation.

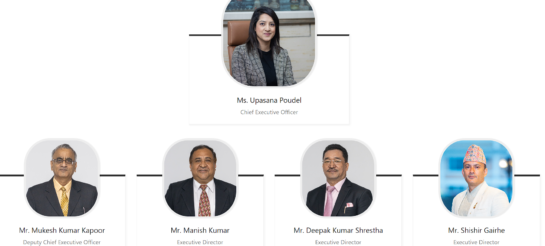

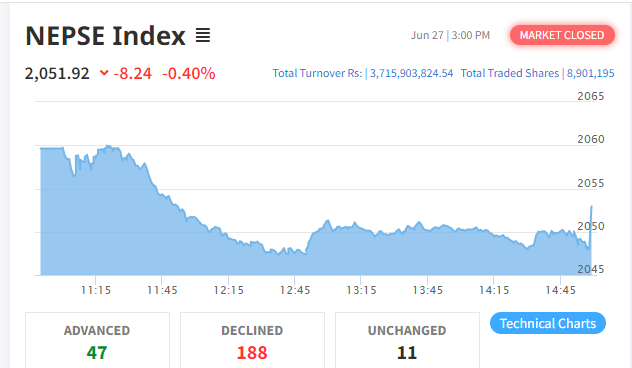

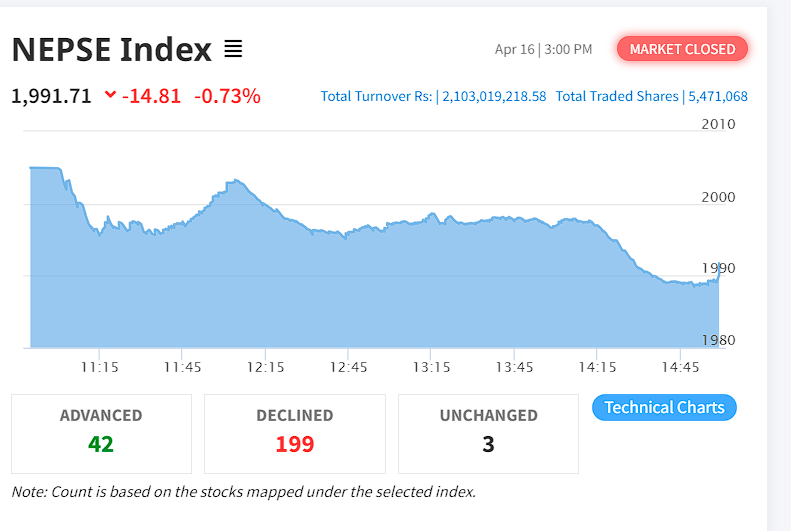

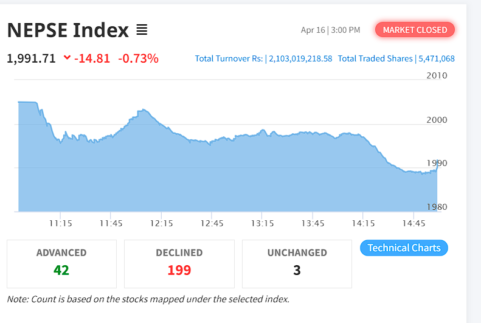

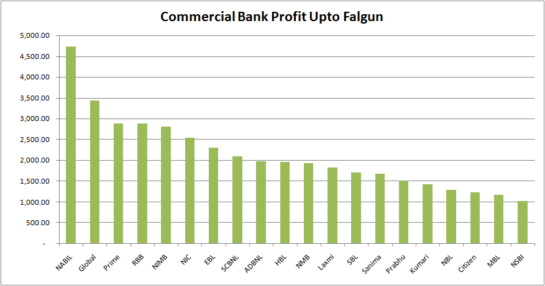

The Nepal Stock Exchange

The Nepal Stock Exchange

.

.

प्रभु केबुलकार एन्ड टुरिज्म लिमिटेडले

प्रभु केबुलकार एन्ड टुरिज्म लिमिटेडले

Khalti

Khalti

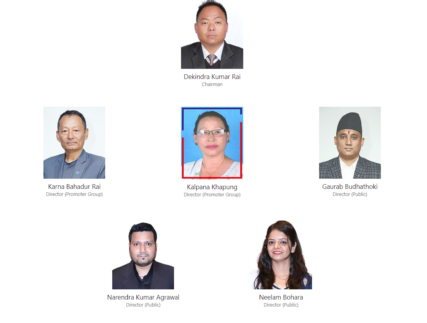

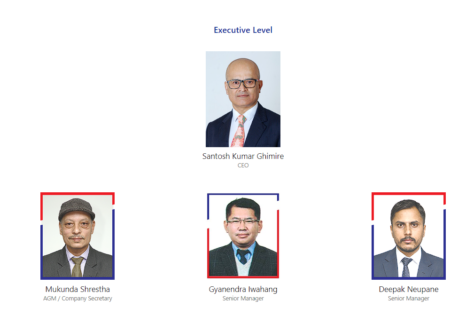

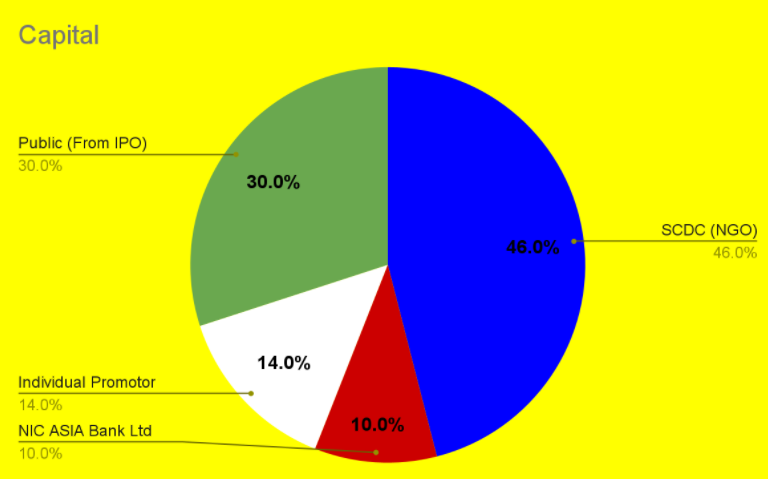

Shrijanshil Laghubitta Bittiya Sanstha

Shrijanshil Laghubitta Bittiya Sanstha

काठमाडौँ

काठमाडौँ

Title: The Evolution of

Title: The Evolution of